Overview

Over the past few months, I have noticed an increase in questions from my U.S. clients that export to countries in the European Union (EU) seeking clarity on their products’ exposure to the new carbon adjustment taxation law upon entry into the EU custom territory.  This surge in inquiries stems from their EU-based customers’ demand that they provide documentation showing the embedded carbon emissions data of their product as a prerequisite for completing the sale.

This surge in inquiries stems from their EU-based customers’ demand that they provide documentation showing the embedded carbon emissions data of their product as a prerequisite for completing the sale.

Understanding the implications of the Carbon Border Adjustment Mechanism (CBAM) is crucial to doing business in the EU. This article aims to provide U.S. manufacturers and exporters with useful insights and clarity on this new law.

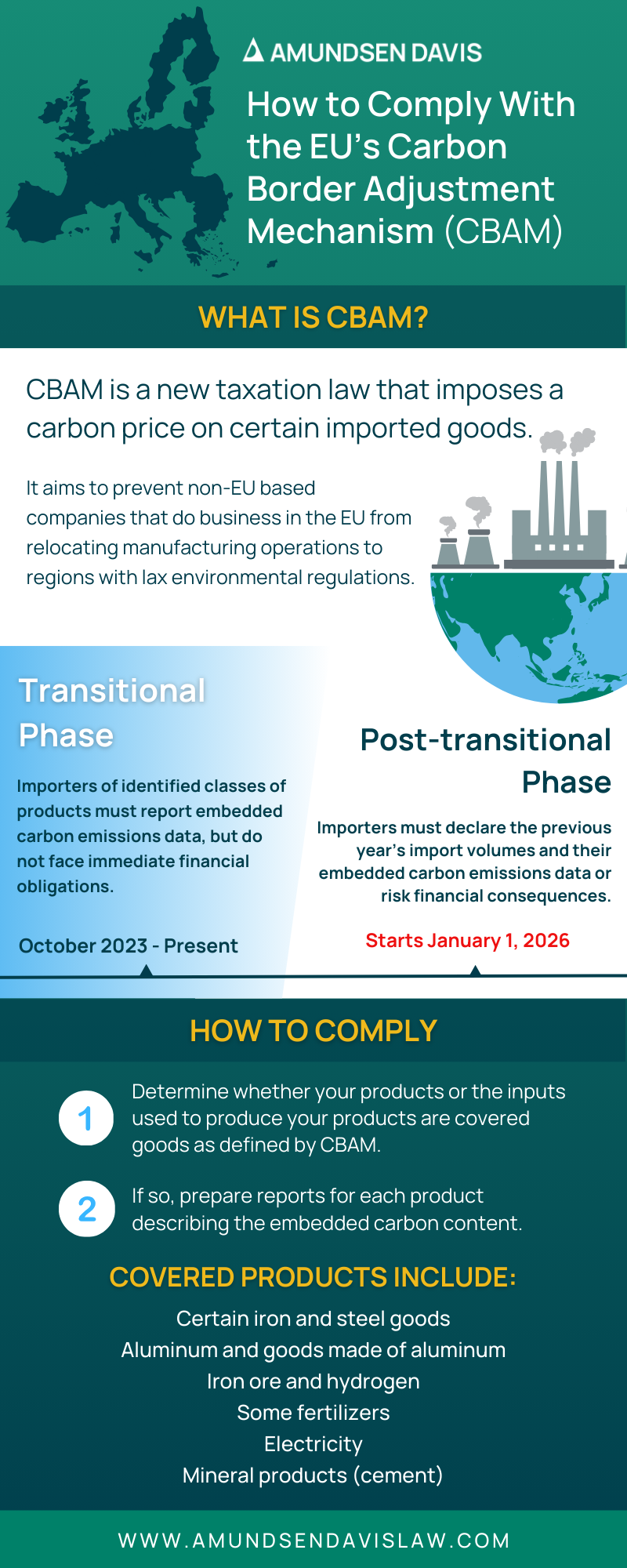

[Infographic] How to Comply With the EU’s Carbon Border Adjustment Mechanism

What Is CBAM and What Products Are Covered?

CBAM aims to prevent non-EU based companies that do business in the EU from relocating their manufacturing operations to regions with lax environmental regulations. By imposing a carbon price on certain imported goods, CBAM aligns production costs with the carbon content of imported items.

Though the law became effective in May 2023, its transitional phase began that October and will continue through January 1, 2026. During this transitional phase, importers of identified classes of products must report embedded carbon emissions data, but do not face immediate financial obligations. Products currently covered under CBAM include:

- Certain iron and steel goods;

- Aluminum and goods made of aluminum;

- Iron ore and hydrogen;

- Some fertilizers;

- Electricity; and

- Mineral products (cement).

Post-transitional phase, importers must declare the previous year’s import volumes and their associated embedded carbon emissions data or risk financial consequences for noncompliance. Further, the scope of the covered products is expected to broaden during that post-transitional period.

Why U.S. Manufacturers and Exporters Should Care

CBAM’s impact extends to EU importers and their foreign suppliers, including U.S. manufacturers and exporters. Whereas importers of these products must report the emissions data, their foreign suppliers are required to furnish accurate data on their products to facilitate compliance.

This entails providing CBAM certificates and other relevant information to enable precise reporting and border tax calculations. For instance, if a Wisconsin-based manufacturer produces aluminum manhole grates and sells them to its Austrian customer who then imports them, the manufacturer must provide data on the embedded carbon emission within the aluminum manhole grates to enable the importer to meet its reporting and carbon tax requirements.

The same would hold true if the aluminum manhole grates were sold to an intermediary in the U.S. who then resells them to its Austrian customers. The manufacturer remains accountable for providing the requisite data. In other words, regardless of how many times the aluminum manhole grates change hands before they are imported into the EU, the importer needs the emissions data from the original manufacturer to comply with CBAM reporting requirements.

Consequences of Non-Compliance

Failure to comply with CBAM reporting requirements by providing inaccurate reports or failing to surrender necessary CBAM certificates shall result in severe penalties set by each EU member state, with the severity escalating based on the duration of the problem.

Even if a U.S. exporter does not import their product into the EU, they will be impacted because sophisticated importers will likely pass the cost of non-compliance via contract to their foreign suppliers, indirectly holding them accountable for their CBAM violations. Thus, failure to facilitate compliance may result in penalties for U.S. suppliers or termination of contracts altogether in scenarios where the issues cannot be rectified.

What Should U.S. Manufacturers and Suppliers Do to Comply With CBAM

To remain compliant, U.S. manufacturers must determine whether their products or the inputs used to produce their products are cover goods as defined by CBAM. If their products fall within CBAM scope, they should prepare reports for each product describing the embedded carbon content. If, for instance, the Wisconsin manufacturer only produces raw aluminum, which is covered under CBAM, it would need to produce a report detailing the raw aluminum’s carbon emission content. If, on the other hand, it procures raw aluminum from an original manufacturer in China and then uses it to produce manhole grates, the Wisconsin manufacturer must obtain the carbon emission data from its Chinese supplier.

The above obligation equally applies in scenarios where the aluminum manhole grates are sold to another U.S. customer before they are resold to EU-based customers. The burden of furnishing CBAM compliant documents persists whether the Wisconsin manufacturer exports covered raw materials or covered finished goods, even if it does not directly export these items into the EU. This means that the supply and sale contracts between the manufacturer and any of its customers or suppliers need to be updated to limit liabilities and indemnities and provide the necessary data to EU-based customers that import the product. These contracts need to be updated at all levels of the covered item’s supply chain.

Conclusion

CBAM underscores the importance of environmental compliance in international trade. U.S. manufacturers and exporters to the EU must proactively engage with CBAM requirements to mitigate risks to their businesses and foster sustainable business relationships with their EU customers.

For more information on what manufacturers can do to capitalize on new opportunities and stay ahead of disruptions to business, join us for the Navigating Trade Challenges: Strategies for Manufacturers in a Shifting Global Landscape webcast.

Read More:

- How to Understand Substantial Transformation in a Country of Origin Determination

- A Guide to U.S. Trade Remedies Laws

- Proper Tariff Classification Impact on Business: How to Avoid Misclassification

- How to Start and Operate a Maritime Ship Business

- How to Implement a Foreign Trade Zone to Mitigate Tariffs